Annual conference of German brickmakers 2024 − industry in a dry spell

“There used to be more tinsel”, with this quote from a sketch by comedian Loriot, Stefan Jungk, President of the Federal Association of the German Brick and Tile Industry (BVZi), pointed out the discrepancy between the situation of the German brick and tile industry in 2022 and mid-2024 in his speech at the 2024 annual meeting of the German brick and tile makers.

The meeting took place on 4 July 2024 as part of a joint conference deep in the south of Germany, in Kreuth at Tegernsee in Bavaria. In addition to the BVZi, the Bavarian Brick and Tile Industry Association (BZV), Güteschutz Ziegel Süd, Fachverband Ziegelindustrie Südwest and Arbeitsgemeinschaft Pflasterklinker also held their annual meetings. The meeting was organised by the BZV.

Industry in a dry spell

While 2022 was still the year of an all-time peak, the situation in which the brick and tile industry found itself in 2023 had deteriorated significantly. The circumstances have not changed since then, as Jungk’s speech and the 2023 production and turnover figures presented by the BVZi in its annual report show.

“The industry is experiencing a draining dry spell that threatens its existence in the long term,” said Jungk. This is due in particular to the significant drop in willingness to invest in residential construction. The sudden and significant rise in construction interest rates has pushed public and, above all, private property developers to their limits. This has triggered many cancellations and planning pauses in new construction. The number of approved residential units fell by around a quarter in 2023 compared to the previous year. The decline in orders hit the single-family and semi-detached house sector, where the brick industry is the market leader, particularly hard. The situation is no better in the renovation sector either, with a historically low renovation rate of 0.71 per cent in 2023. The resulting sales problems are impacting all product groups and forcing measures such as short-time working and temporary production stops.

Jungk cited the transformation to a decarbonised industry as the second challenge facing the industry even after the construction crisis had been overcome. He complained that the discontinuation of the support package for the decarbonisation of the industry meant that the essential financial support needed to successfully overcome this challenge was missing. According to Jungk, “whether our industry will still be able to produce competitively and with green energy in 2045 depends on this.” The switch to alternatives to natural gas must succeed.

Jungk called on the participants and the industry “not to bury our heads in the clay pit.” The topics of housing and housing construction are once again at the top of the political agenda and will play a central role in the super election year 2024 and in the 2025 federal election. The industry is working on both the further development of bricks and the use of renewable energy sources as well as clean and efficient processes for drying and firing.

“Especially the older ones among us know that after every crisis comes a boom. Let’s use the time now to navigate our industry towards the future together. Let’s remain confident,” Jungk concluded.

Statistical figures on the production of bricks and roof tiles in 2023

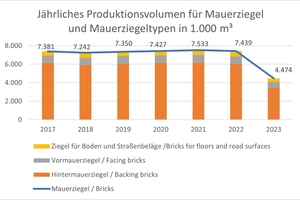

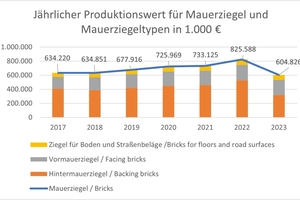

The production volume of masonry bricks fell by around 40 per cent in 2023 compared to the previous year to 4,474,000 m³, the lowest figure since 2010. The production value also fell, but to a lesser extent, by around 27 per cent to around EUR 604 million.

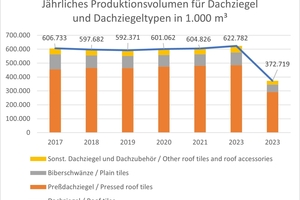

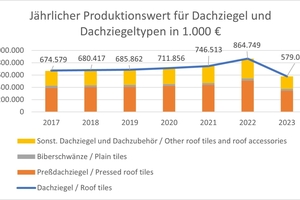

Comparable developments were also recorded for roof tiles. The production volume fell by around 40 per cent compared to 2022, to 372,719 m³. The production value fell by around 33 per cent to EUR 579 million.