Annual report 2008 of the Royal Association of Dutch Clay Brick Manufacturers (KNB)

2008 was a year marked by an unprecedented high oil price in the spring and in the autumn by the beginning of the financial crisis. The Dutch clay brick industry could not evade these developments. The sales of facing bricks declined by 8%, mainly as a result of strongly decreased export (-28%). However the sales of paving bricks made history. Never before did the Dutch clay brick industry sell so many paving bricks (+6%). Total sales of the branch declined slightly (-1%). The worldwide credit crisis has a big influence on the future expectations for the brick and tile industry. For the short term there are challenges ahead in the financial and socio-economic field. For the longer term these are mainly sectorial and are in the field of climate and sustainability. The proven innovation force of the ceramic industry offers a good starting point to face these challenges. This also applies for the collaboration between manufacturers, which has lasted 125 years in 2009, and is jointly responsible for the fact that ceramic products have maintained a future.

1 Sales and market developments

1.1 Building market

The number of dwellings completed fell in 2008 by 2% to approx. 79 000. That is a little lower than in 2007, the top year of this young century. The largest fall of this took place in the last quarter of 2008, namely -11% in comparison with the last quarter of 2007. The number of apartments within the completed new housing rose again. This is regretted by the brick manufacturing sector as ground-oriented dwellings use absolutely and relatively more bricks than a non-ground-oriented dwelling.

The number of permits issued for new homes fell slightly in 2008 (-1%). Despite this fall the number of dwellings awaiting completion has increased to more than 184 000. This is an increase of more than 4% in comparison to the end of 2007.

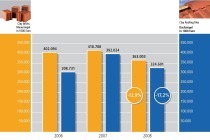

1.2 Sales of facing bricks at historical low

The total national sales of facing bricks fell by 2%. This fall is entirely borne by the Dutch facing brick and is in line with the number of completions in 2008 (-2%).

1.3 Sales of clay pavers at historical high

Of these, almost 35 million WF were delivered as packages for mechanized paving. This is a good result considering the fact that the new development of mechanized paving is requiring substantial adaptations in factories.

2 Innovation and research

In collaboration with the Belgian Baksteenfederatie (Clay Brick Federation) the KNB commenced research into brickwork. Central in this is the development of a test with a predictive value for the risk of white deposits on brickwork. Very little is known about this. Follow-up research started in 2007 into the green discoloration of brickwork and was concluded in 2008. The results of the laboratory research, however, showed insufficient bearing on practice.

Furthermore the KNB was involved in handing out to students of the Technical University of Eindhoven the British ‘Manual for Design of Plain Masonry in Building Structures to Eurocode 6‘ in the framework of the changeover of the curriculum from Dutch into English.

3 Prospects

The Dutch brick industry has 41 factories and a total workforce of approximately 1 600 employees who achieve an annual production of some 1.5 billion bricks.