Belgian brick production down by 16 percent in 2023

Despite the dark clouds and strong headwinds that blew up during 2023 due to higher costs and higher interest rates, Belgium’s construction sector grew by an average of 1.9 percent in 2023 last year, according to official figures from the National Accounts Institute. This is even better than the entire Belgian economy, which grew by 1.5 percent last year. However, several indicators point to a further cooling in 2024. The sharp rise in mortgage rates has made borrowing for a renovation or new construction significantly more expensive. In addition, construction and renovation costs rose much faster than inflation. This has significantly curbed demand for new construction and home renovations. Apart from higher interest rates and higher costs, lower energy prices have also put a strong brake on the renovation market.

The number of building permits issued in Belgium in 2023 for both renovation and new construction was lower than in 2022. According to STATBEL, the belgian statistical office, the number of permits for new-build houses amounted to 50,768 units, down 7 percent compared to 2022. Permits for single-family buildings decreased by 12 percent to 22,635 units. The number of permits for flats experienced a further 2 percent decrease to 28,133 units. The number of licensed renovations of residential buildings in Belgium decreased by percent to 27,475 units (STATBEL). As the number of building permits granted for new construction projects is a good leading indicator of construction activity, this points to an expected slowdown in construction activity in 2024.

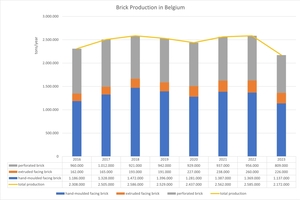

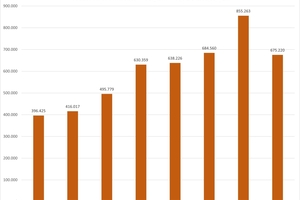

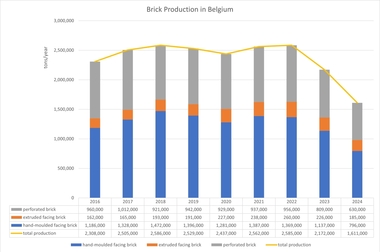

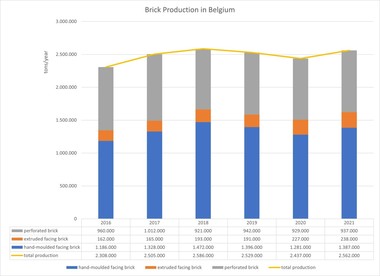

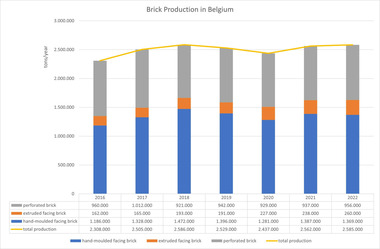

The Belgian brick industry also felt the impact of cooling construction activity in 2023. Total brick production in Belgium was around 2,172,000 tonnes, down 16 percent in 2022. 809,000 tonnes of bricks for ordinary masonry and 1,363,000 tonnes of facing bricks were produced. For several years, brick manufacturers have been marketing slimmer brick products in addition to the classic format. Production of the narrower eco-format facing bricks saw an increase to 1,293,182 m². The brick strips segment evolved to 675,220 m². Exports amounted to 664,679 tonnes representing about 31 percent of total production, down 41 percent. The export figures are compiled on the basis of a member survey and data by the National Bank of Belgium (NBB). Exports were mainly to neighbouring countries. The UK remains the most important export country for facing brick in 2023. With 187,455 tonnes, imports amount to about 8.6 percent of Belgian production (source NBB).

The outlook for construction in 2024 is uncertain. Yet there are huge opportunities for the construction sector in the context of the long-term energy transition. 85 percent of homes do not meet energy standards now. The number of renovations needs to be multiplied by three to four to meet climate targets in 2050. The brick sector itself also faces significant challenges in the context of the transition to a low-carbon industry and society by 2050. In this context, the sector also wants to do its bit and, through a sectoral charter endorsed in June 2023, companies in the sector committed to think individually about this transition and to reduce both their energy and raw material use without sacrificing product quality and functionality. In light of the dematerialisation of products, companies will actively include eco-formats when promoting their range to customers.