At the international pre-press conference for Bau 2011 in Munich, Erich Gluch from the ifo Institute for Economic Research, Munich, presented the results of the Euroconstruct Conference held in June 2010.

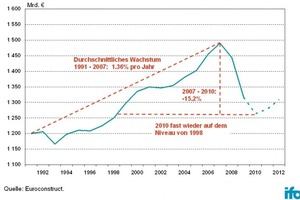

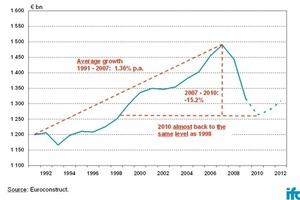

European construction industry with 15-% decline in just three years

After continuous expansion over a period of 14 years, volumes in the European construction industry in 2007 reached almost 1 500 bill. euros. This year the figure is likely to be only around 1 260 bill. euros – a good 15% decline in just three years. The trend was particularly negative in residential construction in Western Europe. The sharp decline between 2008 and 2010 will push annual housing volumes down to around 535 bill. euros, back to the level seen in 1994. The housing markets in Ireland and Spain were particularly hard hit – here building volumes more than halved in just three years. Contrasting with this, the figures for 2007 to 2010 in the Slovak Republic, Switzerland and Germany will show modest growth. And in Poland volumes in the residential construction segment this year are set to be over 25% higher than in 2007.

Revival in 2011/2012

In almost all of the 19 countries analysed, housing demand will pick up in 2011 and 2012. Only in those markets that were severely depressed in the last three years – Ireland, Spain and Portugal – will weak demand continue through into next year and the following year. In Denmark, Sweden, Hungary, the Slovak Republic and Poland, however, building volumes are expected to rise in double-digit figures in 2011 and 2012.

Spain is experiencing particular difficulties – here the number of completed homes has collapsed from around 800 000 in 2007 to a predicted figure of only around 100 000 by the end of this year. A very positive picture emerges, however, in all the segments in the Polish market. Even in 2008 and 2009 the financial and economic crisis made little impact in this country. In 2011 and 2012 residential construction volumes will rise by an average of 7.5% per annum, non-residential construction by an average of 5% p.a. and civil engineering by an averaged figure of as much as 24% p.a.

Despite the considerable growth in Eastern European countries, the main focus of activity in building and construction continues to be in Western Europe, in particular in the “Big Five” countries: Germany, France, Italy, Great Britain and Spain account for around 70% of European building activity. Even the weak development in Spain in the coming years will only minimally affect this focus on the five most populous countries.

Germany with prominent role

The trend in Germany will have special significance through to 2012. Here the overall economy has recovered surprisingly fast from the downturn caused by the financial and economic crisis. Ongoing high demand from most of the newly industrialized countries, combined with interest rates lower than ever before are – and will continue to be – the key stimuli. In addition companies are pleased with increasing demand from the consumer-related sectors. Added to this are projects that had already been planned in recent years, but had been put on ice for the time being because of the downturn in demand in 2008 and 2009. Also observed is a return of some production capacity from abroad. In residential construction higher employment and rising incomes are having a positive effect. Further stimulus comes from a return to rising rents and property prices in the strong-growth regions. The only segment which looks set to contract somewhat in 2011 and 2012 is public sector construction, following the end of economic-stimulus programmes.

Modernization and renovation supporting construction

A not inconsiderable level of support for European construction will continue to come from extensive renovation and modernization activity. In 1992 R&M on existing building stock accounted for around 47% of volumes, but by 2012 this figure will be around 56%, the largest proportion of which will be in residential construction.

Erich Gluch