Ceramic industry in the Netherlands facing challenging times

The Dutch building ceramics industry faces a challenging time of transition and innovation over the next decade. In the meantime, the industry also has to deal with the possibly negative impact of the corona pandemic on the construction sector. Sale of facing bricks already fell in 2019. This along with other facts and figures can be found in the recently published Annual Report 2019 of the Royal Dutch Association for Building Ceramics (KNB).

Challenges

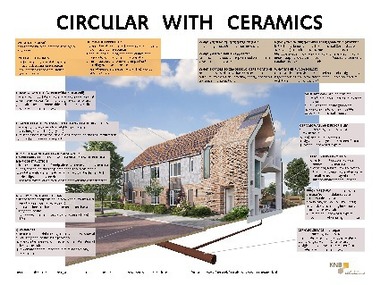

The national Climate Agreement and the European Green Deal, both introduced in 2019, place the Dutch industry for facing bricks and clay pavers, roofing tiles and ceramic wall and floor tiles ahead of many years of complicated transition and innovation. Complicated because clay and fossil fuels are necessary for ceramics building products and not freely interchangeable with any alternative raw material. Nevertheless, the Dutch building ceramics industry has the ambition to make a valuable contribution to the national and European approach for nitrogen reduction, energy transition and the circular economy. In 2019, KNB therefore started a number of activities to respond to these issues:

A multi-year feasibility research study was launched to find sustainable alternatives to natural gas (like hydrogen, biogas, electrification, microwave-assisted processes)

An agreement was made to cooperate and share knowledge with the important New Energy Coalition

KNB’s new Ceramics Transition and Innovation Council has committed itself to setting up a Technology Roadmap for Bouwkeramiek 2030

This Technology Roadmap will be available in the second half of 2020 and provides a solid basis for a coherent programmatic approach to the above-mentioned issues. The new sectoral Sustainability Agenda 2019–2022, published in 2019, takes the United Nations Sustainable Development Goals into account as reflecting points for the sectoral activities

Market for ceramics

Despite robust growth of the construction production as a whole, sales of Dutch bricks decreased in 2019 (-6%). This decrease was partly export-driven (-10%) owing to the uncertain Brexit-process, and partly domestic because of the national impasse on nitrogen and PFAS (per and polyfluoroalkyl substances), a soil substance considered very hazardous and subject to unexpected measures introduced by the government. Especially in the second half of 2019, this negatively affected domestic sales of facing bricks (-4%).

The market for roofing tiles and ceramic wall and floor tiles developed positively in 2019. Sales of clay pavers also increased (2%).

Impact of the corona pandemic

Meanwhile, manufacturers are concerned about the effects of the corona pandemic. ‘’It feels like dancing on a volcano’’, as KNB Director Ewald van Hal said at the presentation of the annual report. “It is necessary to recognize in a timely manner the late cyclical nature of the construction sector, including the building materials industry, in order to keep construction going. This serves the interests of the public looking for new homes and of the national economy as such: every euro spent in the construction sector are three elsewhere in the national value chain!’’

Outlook

Already before corona, it was estimated that the national problems with nitrogen and PFAS would halt the growth of construction production in 2020 and 2021. Under the assumption that structural solutions would be developed for these difficult issues, a recovery of the construction sector was foreseen by mid-2022. In the meantime, the corona pandemic has gained a firm grip on the economy, resulting in an unknown, but potentially significant decline of the construction sector later this year up until 2022. The mid-term effect for the sales of the Dutch brick industry (both domestic and abroad) is unknown.

KNB – Vereniging Koninklijke Nederlandse Bouwkeramiek

www.knb-keramiek.nl