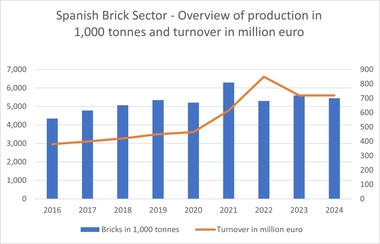

2022 extreme situation for Spanish brick industry due to increased gas prices

According to the press release of Hispalyt, the Spanish Association of Manufacturers of Fired Clay Bricks and Tiles, the brick manufacturing sector has been in a very serious situation since September 2021. This was due to the significant increase and enormous volatility of the price of natural gas.

In 2022, manufacturers faced a 550 percent increase in their natural gas bills. The purchase price of natural gas had increased from around 20 euro/MWh in 2021 to an average of 130 euro/MWh in 2022. For a company with an average consumption of 5,000 MWh/month, this means monthly costs of 650,000 euro in 2022, assuming constant gas consumption, compared to 100,000 euro/month in 2021.

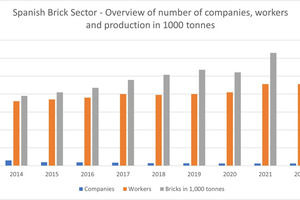

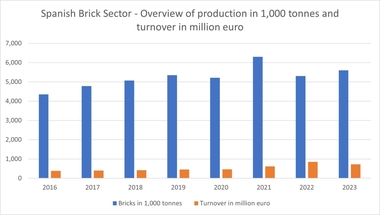

This very tense situation on the gas market is reflected in the sector‘s results for 2022. The number of companies (130) and employees (4,550) remained constant compared to 2021. However, brick production in 2022 was only 5.3 million tonnes, about 16 percent less than in 2021. This decline is due to the fact that many factories had to stop production because they could not cope with the increase in the price of gas.

According to Hispalyt, the analysis of the data as a whole shows that the year 2022 was marked by the war in Ukraine. This has led to an unprecedented increase in commodity and energy prices. This undermines the competitiveness of the sector and means a future full of uncertainties.

Therefore, the Association calls on the Spanish Government to urgently implement the aid line announced in Royal Decree-Law 20/2022 for installations or industrial sectors with a high consumption of natural gas, based on point 2.4 of the Temporary Crisis Framework, in order to compensate for the increase in costs associated with their consumption due to the exceptional increase in gas prices.

Likewise, Hispalyt calls on the government to increase the allocation of this type of aid, as approved by other countries, such as Italy, France and Germany.

Finally, the association calls on the government to urgently approve the new methodology for the remuneration of CHP plants, as the absolute uncertainty has brought most CHP plants in the sector to a standstill.