Full steam ahead against the current - Thermoplan as a full-service provider for all ceramic manufacturers

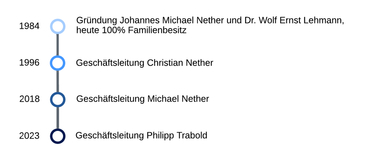

For the company Thermoplan from Olching in Bavaria, 2024 is a very special year. Not only does it mark the 40th anniversary of its founding. The company has also changed parts of its name. Finally, the company is expanding. At the end of last year, the company opened a site in Brilon and integrated Rumke’s employees and business areas. Another site is currently being built in Pressath, where Lippert GmbH closed a few months ago. All of this is taking place during a phase of declining demand for heavy clay ceramics and a correspondingly weak order situation for machine manufacturers and suppliers.

Over coffee in Nuremberg, ZI editor Victor Kapr asked the Managing Director of Thermoplan, Christian Nether, why this anti-cyclical approach. Nether’s short answer is that he is probably a bit crazy. You can read the long answer about his motives and plans below.

1. Plans and opportunities

Mr Nether, Thermoplan is currently going against the trend. Is now the right time for this?

Christian Nether: We have developed very quickly in recent months because opportunities have arisen for us. This started in 2021 when we were able to take over a number of employees and their expertise from the insolvent Trafö. We did the same last year in Brilon when Rumke went out of business and now in Pressath. If we hadn’t taken over there, the people would have been gone. Those are highly trained specialists, some of whom are desperately sought after in the region. Not only from us, but also from large financially strong companies such as Deutsche Post, Hermes or Bosch.

Aren’t you taking a big risk with this?

CN: We keep the risk within narrow limits. On the one hand, we are very flexible due to our company structure and size. This fits in well with current market requirements. On the other hand, we have only gained new colleagues from the companies in question, no facilities nor other tangible assets. We are investing small sums in locations for the new staff at the old sites. We have rented a newly renovated hall in Brilon and a small office in Pressath. That’s all we need in the first stage. We are limiting our orders to final assembly, we are doing away with vertical integration.

What do you want to achieve with this expansion?

CN: We want to expand Thermoplan’s business area with new expertise and new customer relationships. Both were suddenly on the market with the employees of Rumke and Lippert. In both cases, they were suitable additions to Thermoplan’s portfolio with minimal overlap. The opportunity in Brilon and Pressath was therefore too good to miss. With the new capabilities and the new portfolio, we have huge potential and enough work for up to 400 employees.

In concrete terms, however, we are pursuing two goals. Firstly, to establish Thermoplan as a full-range supplier for the ceramics industry. Whatever a ceramist needs in their production, we want to be able to supply it.

Secondly, we want to be in a position to supply entire plants worldwide by 2026. We want to do this both independently and together with partners. To this end, we have established networks with companies whose skills in certain fields complement ours. We bring special expertise in handling, camera technology, drying and control to these partnerships.

In the Advanced Ceramic Network, for example, we work with other companies to pool expertise in equipping technical ceramic manufacturers. We are continuing to expand these networks.

Isn’t this goal of offering complete works a little optimistic? Others have failed.

CN: As I see it, there are very few suppliers on the market for certain ceramic products. There is no other competitor, especially in heavy clay ceramics and porcelain, and we want to fill this gap. At the same time, demand will remain in the long term, albeit with fluctuations. Ceramics have a great future; in many areas, ceramic products are without competition due to their special properties.

2. The company

Thermoplan changed its name at the beginning of the year. Is this related to the expansion?

CN: We founded Thermoplan Messdatenerfassung und Energieoptimierung industrieller Produktionsanlagen GmbH (data logging and energy optimisation of industrial production facilities) in 1984. The name fitted very well at the time because we initially concentrated on process engineering optimisation of thermal process plants. Since then, our field of activity has steadily expanded step by step. Control technology, control systems and storage technology have been added without these changes being reflected in the name. With the new name, we want to reflect these expanded capabilities and present ourselves more confidently as a plant manufacturer.

What does Thermoplan currently offer?

CN: The short answer, together with the now integrated portfolio of the Pressath ceramics supplier, is: almost everything. Plant engineering, electrical engineering, process engineering, quality inspection systems, control technology, software, special machine construction and service. I myself experience surprises in our portfolio. For example, I have learnt that we are the cutting wire specialist in Germany. We supply wire by the metre to brickmakers and suppliers. We also have plaster mixers and dryers in our product range, mainly for the sanitary and porcelain industry. In addition, we are currently preparing an offer for a glove mould casting system.

In which business areas does Thermoplan offer this wide range of services?

CN: We are continuing to pursue our main area of business in heavy clay ceramics. We still see potential for cooperation with larger customers there. But we will become more involved in other areas. Initially, these are all other ceramic sectors: porcelain, sanitaryware, fine, technical and refractory ceramics. We also work for manufacturers of concrete and sand-lime bricks as well as for the stone and earth industry. We also pursue projects in metal processing, including for household appliances, helicopters, wheel loaders and manufacturers of bakery technology and bakeries directly.

Which fields and areas are particularly important?

CN: All areas are important, even if some are currently more significant than others. Our strategy is to position Thermoplan as broadly as possible. That’s why we also see relevant development potential in areas such as storage technology that are not yet so important in terms of the balance sheet. By establishing several strong pillars, we protect ourselves against the risk of downturns in individual areas. Conversely, the fewer mainstays I have, the more dependent I am on the market. And we have been seeing for some time now that one mainstay is not always enough.

3. Markets

How is Thermoplan positioned geographically?

CN: Until 2024, we only targeted Central Europe. Germany was our most important market. We generate around 90 per cent of our sales in Germany. However, this share will decrease because we want to go international. This was not planned, but has simply materialised over the past two months. We now have our first international agencies and are working on opening more. Lippert’s previously almost exclusively international focus is helping us here. We are endeavouring to reactivate the old worldwide network.

How important are heavy clay ceramics for Thermoplan’s sales?

CN: We generate around 60 per cent of our turnover with heavy clay customers, with around 15 per cent coming from other ceramic areas. Storage technology is the third mainstay with around 15 per cent. The remaining 10 per cent comes from various sectors. These shares will probably change, particularly in the heavy clay ceramics sector, due to the economic situation. However, we will not give up this area. I myself am a brickmaker at heart and believe that bricks as a building material will always have a future.

How do you assess the market situation in the industry?

CN: Times are really bad for machine builders at the moment.

The clay block industry will probably still have to contend with sales problems and production declines this year and next and will probably not consolidate until 2026. However, their main concern for the coming year is that things will go even further downhill. The biggest problem is facing the large manufacturers of clay blocks with standardised mass products. This is because the decline in orders, triggered by subsidy cuts and interest rate hikes, is primarily affecting the mass market. In my view, small niche suppliers who mainly deliver locally are doing better, as are project specialists. This is not so much dependent on the product; in addition to the facing brick manufacturers, the small backing brick manufacturers also seem to be getting through the crisis reasonably well.

The reason lies less in the product than in lower fixed and labour costs, so that these manufacturers are not necessarily dependent on putting huge quantities through the oven. They are also more flexible. Facing bricks in particular will survive because their product is more valuable.

4. Prospects

What are the goals for the future?

CN: The most important goal is to turn Thermoplan into an independent and recognisable brand in the next twelve months. Thermoplan is recognised as a company, but I am still too much the face and contact person for customers. I want to change that. Instead of just me, Thermoplan is now represented by a total of ten competent contact persons with many years of experience. They are all well-known experts in the market. These people should be recognised as the faces of Thermoplan. The next step is to significantly increase the visibility of Thermoplan in the industry and beyond, to anchor it as a brand in people’s minds and to publicise the cross-industry portfolio. In future, I want a brickmaker or ceramist in general to immediately have the name Thermoplan in mind when they want to place an order at the plant.

What are your plans for Pressath?

CN: I am optimistic that we can realise the potential there. We already have a handful of former Lippert employees who are organising themselves as a team. The office there has been set up, and now another ten people are joining us. The medium-term plan is to open a production facility in Pressath and hire another 25 employees in addition to the 25 already working there. Preparations for this are currently underway. For the time being, the aim is to get the site up and running without affecting earnings, which we have already achieved for 2024. The hope is that the loyalty of our customers to our existing contacts will help the site to really boom again. The initial signs are more than positive.

What projects are you currently pursuing?

CN: We are working on two major development potentials in the heavy clay sector. One is the grinding plant for backing bricks. We have already mastered this work step in all other ceramic areas.

I would like to offer a complete portfolio in the handling sector. It helps that Lippert specialised in grinding in the porcelain and refractory sectors.

The other topic also concerns, but not only, the backing brick - it’s about cutters. We can already cut slugs. All other cutters, e.g. for brick slips or backing bricks, are the logical next step, not only technically but also economically.

In addition, following our success with quality inspection systems for roof tiles, we are currently developing similar systems for other products. We are also following the major trends of our time: improving energy efficiency and digitalising industrial production (Industry 4.0).