Increased export demand for Dutch building ceramics in 2022

The annual report of the Dutch trade association Koninklijke Nederlandse Bouwkeramiek (KNB) draws a mixed balance for the year 2022. The easing after the Covid pandemic subsided was followed by the Russian invasion of Ukraine and massive effects on energy availability and prices. Construction activities and demand for heavy clay products remained at a high level. KNB assesses the outlook for the current year as uncertain. A high demand for housing is countered by a construction environment that has become more difficult due to interest rate increases. Another challenge for brick manufacturers is the switch to alternatives to natural gas.

Construction industry

At the beginning of 2022, a new cabinet took office with ambitious construction targets: 900,000 new homes are to be built by 2030. At the end of the year, this target seemed further away than ever: rising interest rates, rising construction costs, rising inflation, labour shortages, stagnating permit numbers, an unsolvable nitrogen problem: the lack of sufficient (and affordable) housing is far from solved. Contrary to all expectations, however, the Netherlands was spared an economic contraction in 2022.

However, the number of new building permits issued decreased by 16 percent to 63,000, according to the Centraal Bureau voor de Statistiek (CBS). At the same time, the positive development of building permits in 2020 and especially 2021 brought the construction completions in 2022 to a high level. The number of new houses built in 2022 reached 74,000 (CBS), around 9 percent more than the previous year.

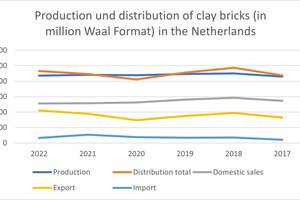

Brick

Despite COVID and the Ukraine war, the Dutch masonry brick industry performed well. Total sales of Dutch masonry bricks increased by 5 percent. This increase was driven by exports (+11 percent to 420 million Waalformaat (WF)). Domestic sales of Dutch bricks remained almost unchanged at 513 million WF. Imports to the Netherlands decreased by around 3 percent. Domestic production was slightly below the previous year‘s level, at 872 million WF instead of 883 million WF (-1.2 percent). Due to the increasing use of brick slips, these figures no longer say much about the development of the total brick façade area.

Paving bricks and clay roof tiles

The energy crisis put pressure on the price difference between pavers and other paving materials. Nevertheless, the (re-)recognition of pavers as an aesthetically and sustainably superior material continues to grow. KNB did not provide any figures.

Demand for ceramic roof tiles remained unchanged in 2022, according to KNB, partly due to a strong renovation market. Stock shortages abroad during the COVID period and problems at a major manufacturer in Germany meant that demand was higher than supply in 2022.

Expectation

KNB sees major uncertainties for the construction and housing market due to the risk of further escalation of the Ukraine war, rising interest rates and uncertainty about the impact of provincial elections on provincial clout. In principle, the conditions for building ceramics sales are excellent, given a construction target of 100,000 new homes per year by 2030 and a wave of preservation of existing properties. In the short term, however, there is not much sign of this. In the meantime, concerns remain about the ability to switch to sustainable alternatives to natural gas.