Netherlands: Demand and production of bricks slumped in 2023

The annual report of the Dutch industry association Koninklijke Nederlandse Bouwkeramiek (KNB) draws a negative balance for the year 2023. Elections and political deadlocks characterised the past year: provincial elections in March, the fall of the Rutte IV cabinet in July and the national elections in November. The consequences were political deadlock on nitrogen policy (the nitrogen crisis is hampering the construction of new buildings, among other things), the construction issue and important transition and climate issues for the ceramics industry. Political progress has only been made in terms of pricing instruments to promote sustainable production in the architectural ceramics industry. This is at the expense of manufacturers who do not have access to green, gaseous alternatives to natural gas. All of this is reflected in lower production and demand for bricks.

Construction industry

The realisation of the ambitious construction targets set by the cabinet, which took office at the beginning of 2022, was thwarted 1.5 years later by a premature setback. Even without this setback, there were (and still are) too many “headwinds” for the construction of 900,000 new homes by 2030. The causes are manifold: sharp increases in labour, material, development and construction costs, higher interest rates, stagnating approvals, planning reasons, but also setbacks in nitrogen, network congestion and water connections. This is also reflected in the figures. While construction output rose slightly overall in 2023, the production of new homes shrank (minus 7 percent).

The Centraal Bureau voor de Statistiek (CBS) recorded a total of 73,000 newly built homes in 2023 (minus 2 percent). As a balance of new construction, division, conversion, demolition and amalgamation, the central government reported plus 90,000 new homes.

The number of permits issued for new homes fell by 15 per cent to 55,000, according to CBS. Permits for owner-occupied homes in particular fell significantly, by around 23 per cent. Given the average lead time of two years between approval and construction, these figures have predictive value for the development of construction output in 2024 and 2025.

Bricks

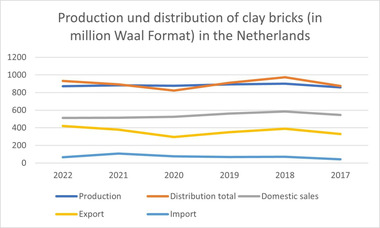

After several years of slight growth, sales of Dutch masonry bricks fell by up to minus 35 percent in 2023. As a result, sales totalled just over 600 million Waalformaat (WF). This is a historic low.

The decline in sales occurred both inland (minus 32 percent) and abroad (minus 39 percent). The latter is in line with the Europe-wide stagnation on the new residential construction markets.

Paving clinker

According to KNB, the decline in construction volume also affected the paving brick market in 2023. Despite the difficult market situation, builders and planners should appreciate the aesthetic and sustainable advantages of pavers. The importance of circularity and value retention is increasing, and pavers make a significant contribution to this. KNB did not provide any figures.

Ceramic roof tiles

According to KNB, demand from the new construction sector for ceramic roof tiles also shrank in 2023, while demand for models that are mainly used in the renovation market remained largely stable. There was hardly any decline in demand here.

Expectations

According to forecasts by the Economisch Instituut voor de Bouw (EIB), production in residential and non-residential construction will fall by around 4 per cent by 2024. New residential construction (minus 11 percent), an important construction segment for the building ceramics industry, will be hit the hardest. This sharp decline is bad news for the construction industry and sad in view of the high demand for suitable living space. In view of the sharp decline in the number of building permits issued in 2022 and 2023, this trend is likely to continue for the time being. The increasing lead times for new construction projects that have already been approved also give little hope. The number of completed flats is expected to fall to 60,000 in 2024 (EIB).

In the longer term, the EIB is optimistic. It sees 2025 as a year of transition to higher production figures for new homes from 2026 onwards. Demand is expected to increase as a result of the energy-efficient refurbishment of existing properties, which will have a positive impact on sales of innovative brick façade products and ceramic roof tiles.