Building construction in Germany: dismal prospects until 2011

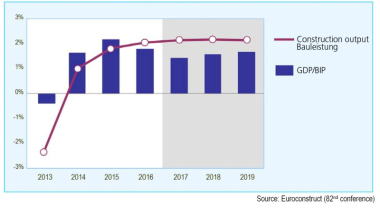

Just last year, Germany’s building construction sector expanded by 2.6 %. For the coming years, however, prospects are a lot dimmer: In their annual construction-sector forecast, the experts at OC&C Strategy Consultants have prognosticated a significant downturn in construction-sector business volume as of mid-year. They are pinning the blame on the global banking and market crisis. According to the study, the market will shrink by 1.8 % in 2009. While the government’s economic stimulation measures will help buoy the market, they will not suffice for a sustainable trend reversal. Depending on overall economic developments, the consultants are expecting the building construction sector to stabilize in the course of 2010 – not before. Non-residential construction is being hit particularly hard by the crisis. Conversely, residential construction has effectively bottomed out after many long years of hefty declines.

Along with all the many challenges, though, the consultants also see definite opportunities looming for the construction industry. “Beginning in the second half of this year“, explains Axel Schäfer of OC&C Strategy Consultants, “the government’s compensatory spending measures, including direct investment in building construction, civil engineering and various indirect measures, will begin to soften the downward trend. Also, thanks to rising rental income from domestic and non-domestic property, the real estate market is already looking more attractive.”

The current forecast for non-residential construction is very dismal. This sector has the most to lose under the present circumstances and will come under intense pressure during the latter half of 2009, when the industry will have worked off its remaining backlog of orders. In commercial construction, the compensatory spending measures will have little positive effect, but public-sector construction does stand to benefit, although the growth will not be able to counterbalance the overarching backslide. Hence, despite the support measures, the entire non-residential construction sector is going to be suffering considerably for the next few years.

Commercial housing construction will be relatively quick to emerge from the crisis and, perhaps, show a bit of growth as early as 2010 or 2011. Increasing rental income and growing demand for housing in population centres are already attracting investors. The private housing sector has been in the doldrums for years already, and the OC&C study sees an end to the downward trend there. The consultants are forecasting medium-term stabilization in that branch.

The housing sector in eastern Germany is suffering more under the current situation than in the west. There are two main reasons for this: first, the continuing migration from east to west is lowering the general demand for housing; second, there is little demand for building renovations in the eastern part of the country, because most buildings now in use have been renovated from the ground up within the last 15 years. OC&C is therefore expecting a decline in all segments of the construction industry in eastern Germany this year. If the overall economy should happen to recover quickly from the crisis, stabilization of the market may be anticipated for 2011.