European construction sector will keep growing

1 Construction output

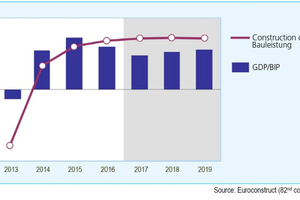

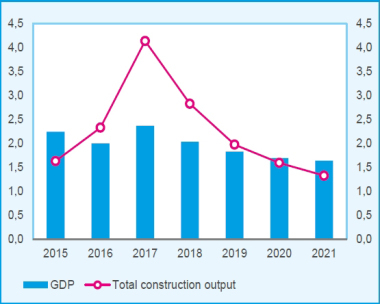

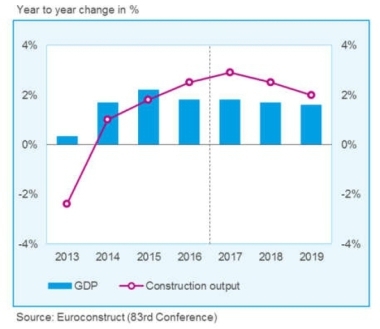

The new estimate for construction output in the Euroconstruct countries in 2016 is 2 %. But the real problem is not that growth we were expecting and has not come about, but the fact that behind that European average that still looks healthy there are far too many exceptions: lack of growth in civil engineering and lack of growth in five countries (Poland, Hungary, Czech Republic, Slovakia and by a narrow margin, also the United Kingdom), »1.

2017 starts without very encouraging economic expectations (just 1.4 % GDP growth) but the construction sector has the potential to grow somewhat more (2.1 %). There is an interesting window of opportunity created by a combination of cheap credit and a more favourable perception of building as an investment shelter. However, this opportunity may be ephemeral, and not a driver for the longer term. The key factor for strengthening the construction sector is public demand, which Euroconstruct expects to keep improving, but only marginally and in some countries. With such weak foundations, the growth expected for 2018 and 2019 is between 2.1 and 2.2 %. Nevertheless, if the forecast becomes a reality, the European construction sector will reach 2019 with uninterrupted growth for six years in a row. This would put the output level at only 3 % below the 1995-2015 average.

2 Performance of the main segments

2.1 Residential

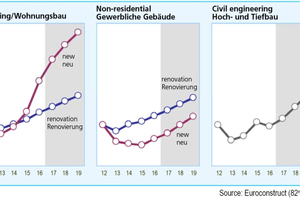

The forecast for residential is the only one that has been revised upwards and includes a substantial improvement on the 2016 estimate (3.9 %). New housing construction in particular has assumed the role of maintaining the recovery pace of the whole European construction industry. Spain and Italy may still be producing way below their averages, but France, Germany and even the United Kingdom are returning to their comfort zone. Production is also improving in other smaller countries, frequently because the demand has come to life and has found little housing on offer because of the low output in recent years. Credit may not remain as favourable as it is today for much longer, so the trend for 2018-2019 is prudent, round 2 % (»2).

2.2 Non-residential

Non-residential construction is still at the very early stage of its recovery process, since its new building component has been decreasing until 2016. Therefore, the present downgrade in the economic outlook comes at a very inconvenient time, cooling the already weak demand for industrial and tertiary assets. Euroconstruct does not expect quick changes, so growth for 2016-2017 will be around 1.5 %, and 1.8 % for 2018-2019. Office construction will perform somewhat above these averages, since it comes from a period of significant contraction. It is worrying to see that industrial and storage construction are expected to perform below the non-residential average, which is a sign of low expectations from demand (domestic, European, worldwide). The United Kingdom has suffered a downgrade in its non-residential segment, and the growth expectations forecast before the referendum are fading. Non residential construction in Germany confirms its downward trend, in a context of caution in investments. The bad results in those two key markets can not be fully offset by the improvement in markets like the Netherlands, Belgium and Denmark.

3 Performance by countries

The increase in construction output in 2016 will come mostly from Germany. But the German pull on European construction will begin to fade: it will drop to the second position in 2017, and in 2018 Germany will disappear from the list of top contributing countries. This will leave France as the main generator of extra output throughout the whole forecast period.

Italy is a reliable contributor too, holding either the 3rd or the 4th position each year; and the Netherlands also, that fluctuates between 3rd and 5th.

The absence of the UK among the top contributing countries during 2016 and 2017 will be noticed, but it re-enters the list in 2018 and becomes the 2nd contributor in 2019, with almost the same output as France.

The small size of the Irish market is no obstacle to finding Ireland among the top-10 in each year except in 2018, when it barely misses it because it drops down to 11th position.

The Summer’17 Conference will be held at Amsterdam, from 8th to 9th June, and it will be hosted and organized by EIB, the Dutch member of Euroconstruct.