Euroconstruct expects growth trends to weaken in European construction

Of the EC-15 countries, ten of them achieved a higher total construction volume in 2018 than in 2007. Despite four years of growth in a row, the construction market in Spain remains at just a quarter of its 2007 level, while in Italy and Ireland it has reached just a third. In contrast, the level of construction in Poland in 2018 was 63% higher than in 2007.

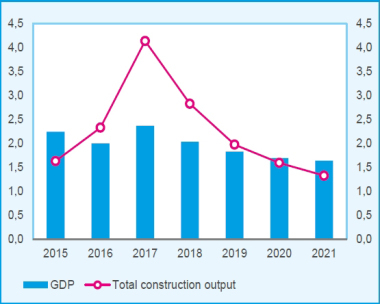

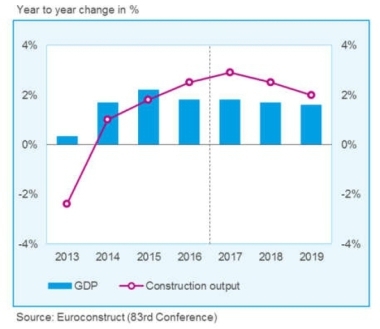

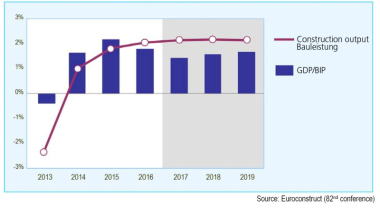

The current, medium-term Euroconstruct forecast indicates a weakening of growth trends in European construction. External turmoil and turbulences in world trade are reducing industrial production and the willingness to invest in Europe. The overall economic situation is still considered positive, even if it is worsening. The latest macroeconomic forecasts do not predict a global crisis, but only a moderate increase by 1 to 2% in the years 2020 to 2022.

The favourable conditions for the development of construction result mainly from the economic aspects (purchasing power of the households, financing conditions, economic growth and increase in profits, funds), demographic effects (although slowing down), infrastructure conditions and the governments’ environmental policy.

The majority of the influencing factors are turned towards an increase in construction output over the next couple of years.

On this basis, Euroconstruct predicts that the rate of the production growth in the Euroconstruct area will decline from 3.2% reported in 2018 to 2.3% in 2019, and in 2020 to 2022 it will stabilize at the stagnation level of 1%.

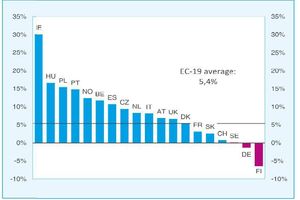

After five years of high and much faster growth in new construction than in the renovation, following the deceleration of new investments in 2020, these trends will be reversed in the years 2020 to 2022. All types of construction in 2020 to 2022 will face a reduction in the average annual growth rate, including civil engineering to 2.2%, non-residential by 1% and residential construction by 0.5 %. The strongest cumulated growth in 2019 to 2022 (+30.1%) is expected for Ireland, followed by Hungary (+16.6%) and Poland (+15.4%).

Negative forecasts are predicted for the largest European construction market, Germany, which after a slight increase of 0.8% in 2019 will reduce the sectoral production in 2020 to 2022 by more than 2%. This development is not very different from that in France, but associated with a decrease in the non-residential investments, namely for the new non-residential buildings and the infrastructure sector.

Much more negative are the expectations for the Nordic countries, namely Finland and Sweden, where the level of output is expected to fall in the next three years.

Euroconstruct

www.euroconstruct.org