Surge in Italian ceramic machinery sales

The Italian ceramic and brick machinery and equipment manufacturers reported a 53.9 % increase in turnover in the first six months of 2021 compared to the first half of 2020, when the industry was hit by the nationwide lockdown from March to April on top of the ongoing slowdown in capital goods investments. This included significant increases in both domestic sales (+55.6 %) and exports (+53.5 %). The second quarter brought even stronger growth (+76.2 % compared to the same period in 2020), driven by higher domestic sales (+90.3 %) and exports (+70.1 %). However, the most reassuring figure emerges from a comparison with the pre-pandemic period, with turnover up 12.8 % in the first half of 2021 compared to the first six months of 2019. This is a particularly significant trend for the entire sector and bodes well for a turnaround in 2021 following years of decline. The downturn in 2020 was also confirmed by the Mecs-Acimac Research Centre’s 29th National Statistical Survey, which provides an annual overview of the sector’s performance and revealed a 2020 turnover of 1.48 billion euros. The signs of a slowdown already observed in 2019 continued and the decline in volumes reached -14.5 %. This figure reflects the difficult global economic situation caused by the pandemic coupled with the ending of the Industry 4.0 tax incentives in Italy and the decline in investments in new technologies that began in the second half of 2018. In 2020 there was virtually no change in the number of active companies (down 1.4 % to 139 compared to 141 in 2019) and in the number of employees (6,951, a small 0.3 % reduction).

International markets

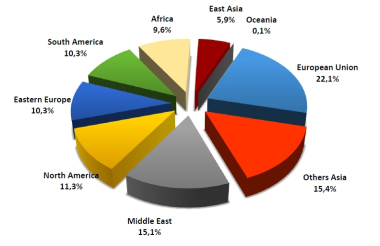

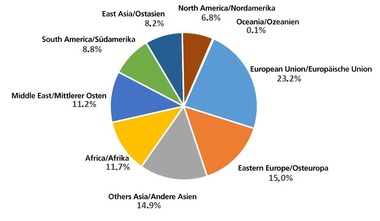

In line with the figures for 2019, export sales accounted for 73.4 % of the total (1.086 billion euros) while falling by 13.9 %. The European Union remained the main target market for Italian ceramic machinery, accounting for 27.9 % of total turnover (299 million euros). Asia (India, Malaysia, Thailand, Vietnam, etc., excluding China) ranked second with a value of 161 million euros and a 14.8 % share of the total, followed by South America in third place with 139 million euros (12.8 %). China/Hong Kong/Taiwan was the only macro region to see growth in turnover with respect to 2019 with more than 100 million euros compared to the previous year’s figure of 66 million euros (+57.6 %).

The domestic market

The domestic market contracted by 392 million euros in 2020, 16.1 % down on 2019.