VDMA Construction Equipment and Building Material Machinery:

Great Differences across Markets

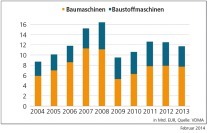

Last year’s overall sectoral turnover of Euro 13.3 bill. – with Euro 9 bill. for construction equipment and Euro 4.3 bill. for the building material machinery sector – is likely to be mirrored by the sector in 2016.

Building Material Machinery: No Upswing in Sight

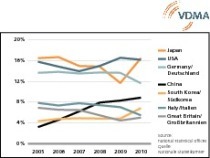

The building material plant and machinery business is always subject to less volatility than the construction machinery sector due to its long-term nature. However, manufacturers are dependent on long-term stable growth markets and these are lacking at present. Only Central Europe, India and North America can be rated as satisfactory. It is primarily the breakdown of the immensely important Russian market that causes major problems for manufacturers. Unfortunately, it does not look as if another market could make up for it shortly.

Overcapacities on the customers’ side present a major challenge for manufacturers. This is particularly, though not at all exclusively, true for the cement sector. When it comes to excess capacities, the sector also automatically thinks of China these days. “We do not expect suppliers from China to flood the market with their equipment but the trend is clear – when domestic markets are weak companies shift to export markets”, says Johann Sailer, Chairman of the VDMA Construction Equipment and Building Material Machinery Industry Association, explaining the increasing competitive pressure from China.

It is fair to say for all sub-sectors that the political and economic uncertainties in many areas are huge and there is growing instability. It is all the more important to stress that the construction equipment and building material machinery industry is indeed a growth sector – and will also be back on track in the emerging markets sooner or later.

VDMA Fachverband Bau- und Baustoffmaschinen

www.vdma.org