The German construction equipment and building material machinery sector‘s nearly 18-month recovery phase appears to be over. Nevertheless, present figures indicate that the branch will have registered some 20% growth this year“, explains Dr. Christof Kemmann, chairman of the VDMA – Construction Equipment and Building Material Machinery Association. “On the other hand, the general mood is not as good as the real figures purport“, Kemmann notes. He sees the financial markets, the Euro crisis and the attendant disorientation as the main culprits. In the broader sense, German construction equipment and building material machinery manufacturers actually did quite well during this second year following the crisis. Especially the demand for construction machines developed nicely after an even stormy onset.

During the first nine months of 2011, Germany‘s entire construction equipment and building material machinery sector upped its revenues by an inflation-adjusted 23% over the same period last year. Construction machinery alone registered an even better 29% overall and 22% on domestic sales (31% on exports). Sales of construction material, glass and ceramic machinery were higher by 8% for the period. Conversely, however, new orders dwindled increasingly as the year progressed.

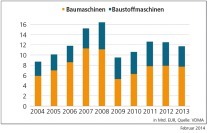

According to present figures, VDMA expects the construction machinery sector to close out the year with a substantial 25% increase in revenues, to 7.8 bln Euro, while the gain for construction material machines will probably amount to 10% and 4.7 bln Euro. Hence, the entire sector together can be expected to have expanded some 20%, to 12.5 bln Euro.

Shifting sales markets

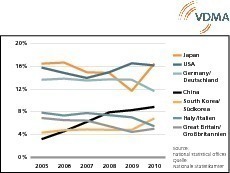

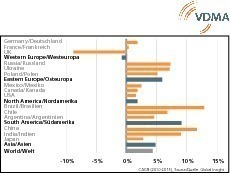

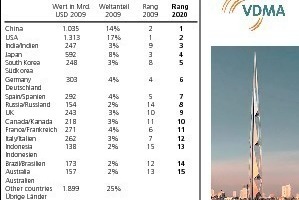

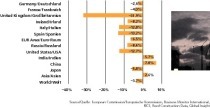

Markets are shifting, and that poses a challenge to the companies concerned. Over the past decade, the industrialized countries have been losing ground as important markets, while the emerging economies have profited, first and foremost Asia. China presently accounts for 52% of the global market for earth-moving machines. By contrast, Europe and North America together represent only a good 25%. Apart from China, it is India, Russia and Brazil that have gained the most attractiveness in recent years. Consequently, the branch has been investing more in those countries, too. “No one trying to develop a new market nowadays“, contends Kemmann, “can get by on exports alone.“ Customers do not want to wait several weeks for spare parts or a service technician. The world is smaller now, and more closely networked. But, so are the crises. Kemmann calls attention to how his association has been accommodating the market drift with new activities. This year, for example, the federation launched a Latin America initiative in order to finally, and systematically, tap into that potential for the good of the branch. The boom region Indonesia is presently VDMA‘s other main-thrust area of market cultivation.

Branch expecting

5% growth in 2012

The branch is finding it difficult to arrive at a forecast for 2012. While the growth generators of recent years are still intact, there is still widespread angst going around about a possible relapse into a new global recession and the resultant plunge in new capital expenditures. VDMA, however, sees Germany‘s construction equipment and building material machinery industry heading for moderate growth of some 5% in 2012. This will be borne not only by Asia and Latin America, but by Central Europe as well, as the latter has been doing some catching up lately.