Ceramic machines in Italy: The sector holds with 2.37 billion turnover in 2023

09.09.2024The growth of the sector represented by Acimac is slowing down, but still closes 2023 with +0.9% over 2022. Exports are worth 1.72 billion. President Lamberti: "Despite the complicated economic situation, the sector has not fallen behind.

The Italian ceramic machinery and equipment manufacturers sector ended 2023 with an upward revision of its turnover for 2022, in fact setting a new all-time record. In fact, the sector consolidated its position at EUR 2 billion to EUR 2,373 million. The increase was only one percentage point (+0.9%), marking a marked deterioration in the pace of growth (in 2021 it had been +39%, in 2022 +14%). The overall turnover is actually the combination of higher growth (+1.8%) in foreign sales and a slight decline in domestic sales (-1.2%). The result exceeded expectations, even shattering the pre-consensus estimate of 2.31 billion.

The data were released by the Mecs - Acimac Study Centre in the 32nd National Statistical Survey, which every year photographs the performance of a sector comprising 138 companies (one more than in 2022) and 7,281 employees (-0.6% compared to 2022).

International Markets

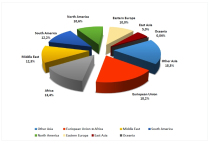

Exports by Italian companies supplying machinery and equipment for the ceramic industry generated a turnover of 1.72 billion euro (+1.8% over 2022), the highest ever since statistics were compiled. The percentage of the entire turnover is 72.7%.

The European Union remains in the lead as the reference basin for Made in Italy, despite the abrupt braking recorded: 387 million invoiced, with a drop of -27%. South America jumps to second place with 302 million and a leap of +38%. On the third step of the podium is the Asian region (India, Indonesia, Vietnam, Thailand, Bangladesh, etc., excluding China), with 296 million (+14% over 2022). This is followed by the Middle East, North America, Eastern Europe, Africa, East Asia (China and Taiwan) and Oceania.

The domestic market

Sales on the Italian market remained substantially stable, dropping only -1.2% and closing the year at EUR 648 million (in 2022 the run had stopped at EUR 657 million).

Customer sectors

It is the breakdown of turnover among customer sectors that is the most significant finding of the 2023 survey. While on the one hand the tile industry saw a drop in turnover (-1.3%, with turnover dropping to just under Euro 2 billion), on the other hand it saw growth in bricks and tiles (Euro 134.6 million, +24%) and sanitaryware (Euro 118 million, +8% over the previous year).

Turnover by Production Type

The changes in the share of turnover achieved by the various types of machinery see moulding machines (Euro 407 million, -14% on 2022), moulds (-4%), firing equipment (-14%) and finishing equipment (-5%) fall back. On the other hand, soil preparation machines (EUR 418 million, +15%), drying machines (+13%) and storage and handling machines (+26%) grew.

Expectations for 2024

The Statistical Survey carried out by the Mecs Study Centre also revealed the expectations of companies in the sector for the current year, which is characterised by general uncertainty on international markets. It emerged that 28.3% of companies still estimate a growth in business, compared to 31% who expect stable results in 2023 and 40% of pessimistic entrepreneurs who foresee a drop in business.

"A slowdown, but without relenting“

"Basically, the 2023 consolidated data have confirmed the idea of the pre-consumptions: we are indeed faced with another all-time record, but we cannot toast given the abrupt braking of the sector's growth curve,' says Acimac President Paolo Lamberti. 'The 2023 picture seems to be the antechamber of a reduction in turnover, which we are verifying in this 2024. However, we should also point out the great flexibility of our sector, given the compensation that arrived in 2023 both on the export front, with some areas compensating for others that went wrong, and on the customer sectors front, with interesting growth coming from bricks and sanitary ware, which in fact fully compensated for the slowdown in the Tile sector. The continuing conflict on Europe's doorstep increases geopolitical uncertainties and the burden of interest rates is still heavy, not only for Acimac companies, but also for their customers. 2024 will be tough, but we are not backing down, always trusting in the technological leadership role that everyone continues to recognise in us and in ever more advanced technologies at the service of the entire global ceramics industry.

Associazione Costruttori Italiani Macchine Attrezzature per Ceramica

(ACIMAC)