Belgian brick industry produces far more brick slips

The Belgian construction industry came out of 2019 well with an increase of 2%. This put the brick industry on a similar level to 2018. In 2020, the construction industry got off to a very promising start. Since March 2020, however, the corona pandemic has led to great uncertainty, not only with regard to developments in the next few months, but also from a long-term perspective.

An overview of the construction industry

The construction industry is an important driver for the economy overall and will also be a key instrument for its recovery. Specifically for the construction sector, the introduction of a number of special measures to encourage new construction, demolition and reconstruction, renovation or public works can contribute to this.

The number of issued construction permits is a good yardstick for the activity expected in the industry. In Belgium, the number of construction or renovation permits in 2019 was below that of 2018. According to STATBEL, the Belgian statistical office, the number of construction permits for newbuilds fell to 56 000, 10% down on 2018. Authorized renovations of residential buildings in Belgium in 2019 totalled 28 000, hovering on the same level as in the previous year.

This development also applies to Flanders. In 2019, 42 900 new homes were approved. That means a decrease of 13% for residential newbuilds compared to 2018, but is, however, still on a higher level than in the time period from 2007 to 2017. The decline in Flanders can be explained perfectly with the stricter requirements for energy efficiency that came into force at the beginning of 2018 and led to an extraordinary peak in permits in 2018. In 2019, 58% of the construction permits were for apartments; in 1996 these made up just 35%. The construction permits for newbuild apartments was much lower than in 2018, with a decline of around 20%. The number of construction permits for new houses fell by 2% to around 18 000 permits.

In Wallonia, a slightly positive development could be observed for the number of approved new homes. The permits granted for houses (6019) rose by 3%. The number of permits for apartments remained constant (5759). The number of permits for renovation projects fell by 5%.

The construction permits for new apartments and houses in the region around the capital Brussels fell by 9% compared to 2018. The construction of newbuild apartments fell by 8%. The share of apartments in the total number of construction permits for newbuild reached 95% here in 2019. In contrast, construction permits for houses rose by 11% and reached 71 homes. There were 6% fewer approved renovation projects in this region.

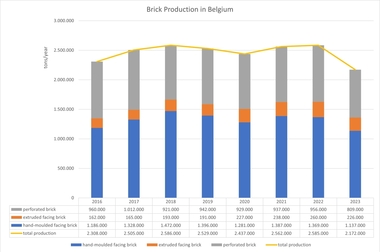

Brick production matches 2018 level

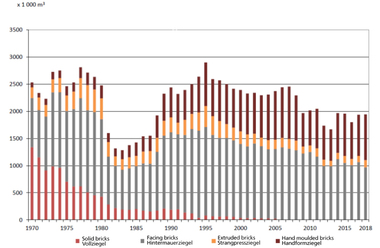

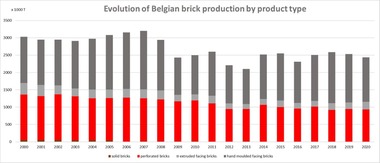

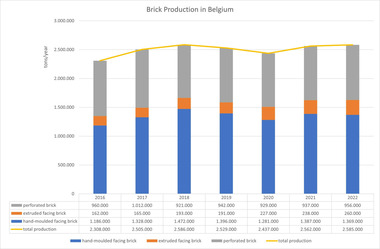

Brick production in Belgium reached 2 529 000 t and remained in 2019 on the same level as 2018. Exports total 808 143 t, making up 32% of production overall. The United Kingdom remains the most important export market, followed by the Netherlands, Germany and France. The export figures were compiled on the basis of a survey among the association members. The import figures rose compared to the previous year to 202 000 t and accounted for 8% of Belgian production. In 2019, 942 000 t masonry bricks were produced, solid bricks were not made.

The production of facing bricks totalled 1 587 000 t. Divided into extruded and hand-moulded bricks, 191 000 t and 1 396 000 t were produced, respectively.

The industry also makes a wide range of brick slips, which are used in various construction systems, both for newbuilds and refurbishment. In 2019, the production of brick slips totalled 630 359 m2, an increase of 27% compared to 2018.

FBB Fédération Belge de la Brique asbl

www.brique.be