Confidence and an economic stimulus programme – two key pillars

Between January and May 2020, the incoming orders of construction equipment manufacturers at production sites in Germany declined by 26% compared to the previous year. As such, the industry lived primarily off order backlogs and sell-offs. One positive aspect is that projects were not cancelled, but rather delayed where this was necessary. Machinery sales in Germany fell by 8% from January to May and were thus relatively stable. The European market collapsed by more than a quarter during the same period. The figure for the German market will deteriorate further for 2020 as a whole but is currently not anticipated to fall significantly further than the economic downturn that would have been expected without the Covid-19 crisis.

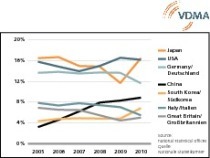

For Europe, the industry anticipates a decline of approximately 25%. The United Kingdom, France and the Southern European construction equipment markets are particularly heavily affected by this. After five months, the global market has declined by 15%. A slight deterioration can be expected for 2020 as a whole. China has recovered strongly following the crisis. Owing to the importance of the Chinese market, the worldwide downturn is smaller than could be expected when observing certain regions: there are big question marks around North America, Latin America, India, South-East Asia and the Middle East. Overall, global industry sales from German production are still expected to fall by 10 to 30% for 2020 as a whole.

The situation for construction materials plant engineering is rather different, as large projects often determine business. In most cases, these are large investments with a long lead time. As such, a lack of such investments will only become noticeable at the end of this year and during the course of 2021. Sales are expected to decline by around 20% this year. The uncertainty of clients is a significant factor here, with their liquidity playing a more minor role.

Trends

31% of trade association members still believe that they will return to the sales level of 2019 by 2021. Another 47% estimate that this will be possible by 2022. Nobody believes that it will take longer than four years for the industry to recover.

Future topics for the industry include digitalization, the autonomous construction site, sustainability and progressive construction, as well as climate change and all of its facets. Furthermore, technology and connectivity on construction sites will increase, which will have an impact on existing professions – another challenge.

VDMA

bub.vdma.org